SavvyMoney® Credit Score

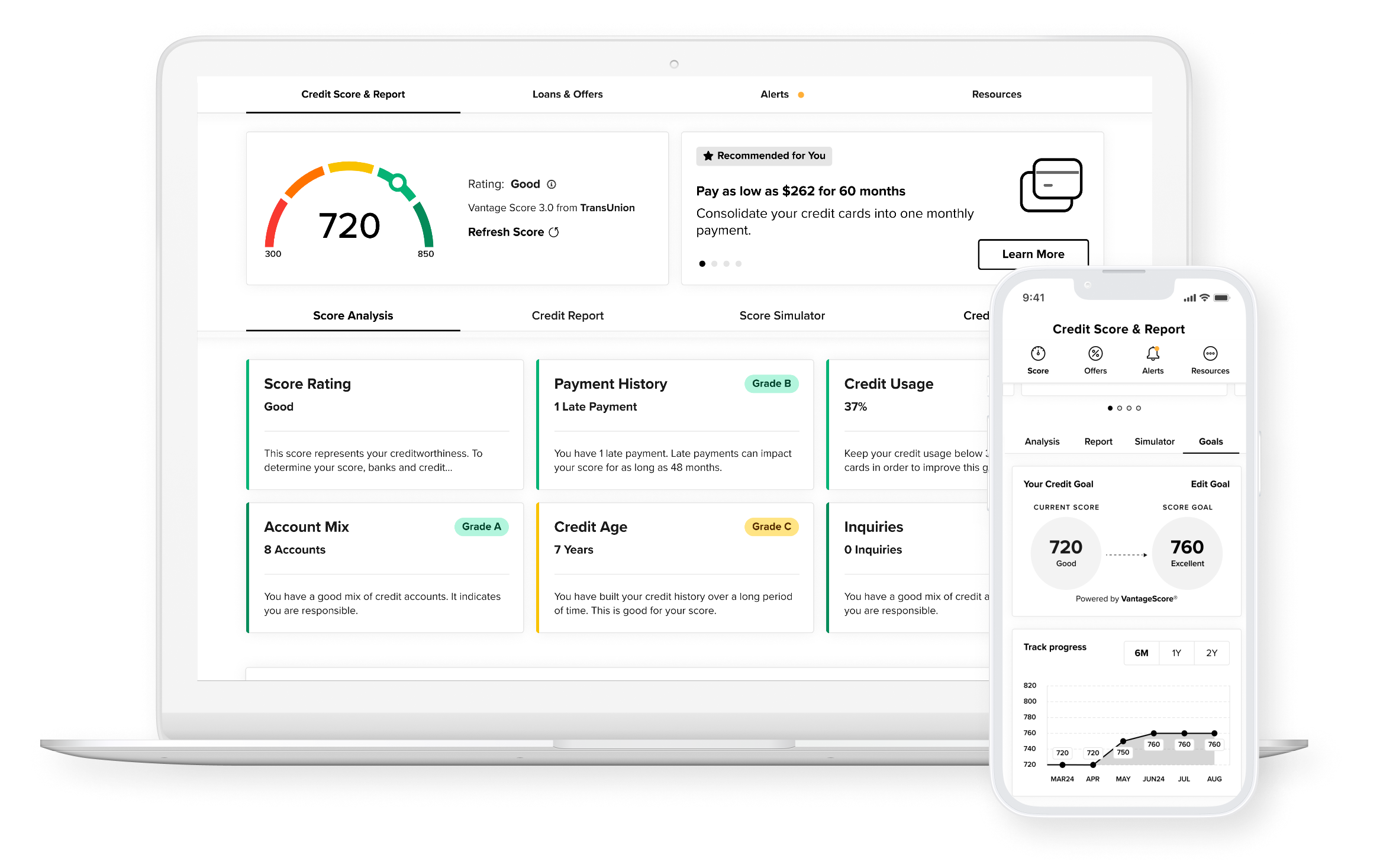

Your Credit Score and More. Anytime. Anywhere.

Your Credit Score and More. Anytime. Anywhere.

With one powerful tool, access your credit score, full credit report, credit monitoring, financial tips, and education.

Tracking your credit score is easier than ever—it can now be displayed right on your Digital Banking dashboard. By staying in touch with your score, report and monitoring updates, you put yourself in the best position to truly discover financial freedom.

Enroll in SavvyMoney® to view your credit report and to get started.

How can SavvyMoney help me?

Tools offered by SavvyMoney include:

Is it really free?

Is my information safe?

While your SavvyMoney credit score may differ from the scores we get from the credit bureaus, our goal is to provide you with the best offer we can. If your SavvyMoney score is different than the score we have, simply print out your score and let us know. We will review your information and determine if there is a better offer we can provide you.

As it relates to all first mortgage loans (with the exception of a Home Equity Loan or Home Equity Line of Credit), we cannot use your SavvyMoney credit score for pricing or underwriting consideration.

These services are provided by SavvyMoney, Inc. and do not represent any agreement by WyHy to provide any product, service, or other benefit. Information provided by SavvyMoney, Inc. is for educational purposes only and is intended to assist you in better understanding the factors that influence your credit score. It is not used for Loan approval purposes, or for determining loan rates. Loan rates and approvals are based on information provided to the credit union when you apply for a loan. The credit score you may see from SavvyMoney may be different from the credit report WyHy may run and will not be used at a specific time when making a request with WyHy for products requiring a credit score. Terms and conditions are subject to change at any time. Enrollment in online banking and SavvyMoney required. Must be a WyHy member to enroll.