Gearing up to tackle your taxes?

April 15 is the federal tax deadline for individuals and small businesses in 2026.

⚠️Tax Refund Information⚠️

When setting up direct deposit for your tax refund, be sure your account number is entered correctly.

Use the suffix first, then leading zeroes, followed by your account number to create a 10-digit number.

Examples:

Savings: 0100123456

Checking: 9000123456

Incorrect formatting WILL result in your refund being returned.

Below are some of our frequently asked questions--have a question that's not listed? Call us at 1.800.442.2392. We'll not only get your question answered, but look into adding it to this list, too!

Q: Who gets tax statements?

A: Any member who receives $10 or more in dividends a year will receive one.

Q: When do tax statements come out?

A: Digital statements are processed in January, and are available through the WyHy Digital app. Hard copy statements will be mailed directly to members by February 1.

NOTE: Not all members will receive tax forms. Please use the table below to determine if you should have received one.

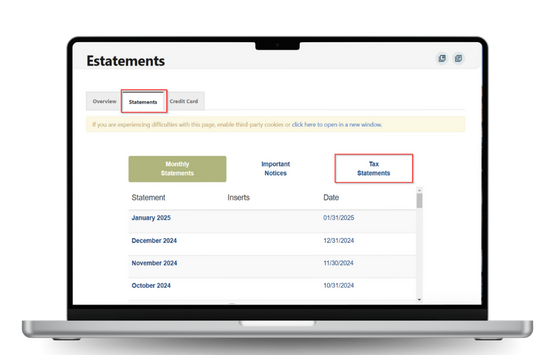

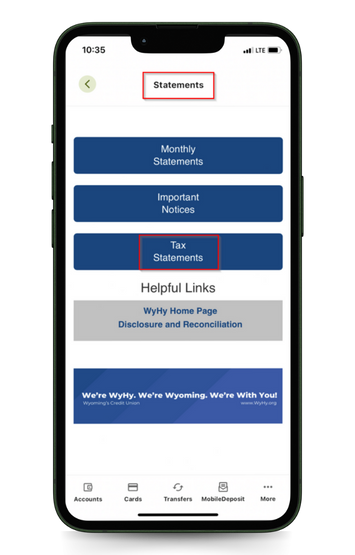

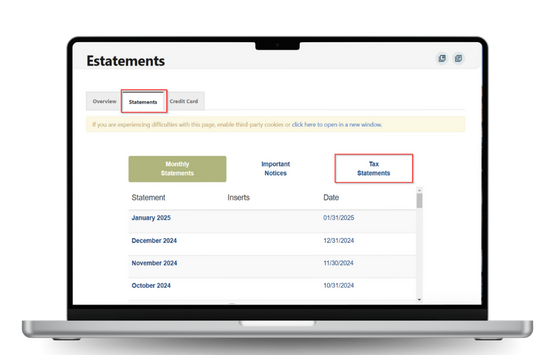

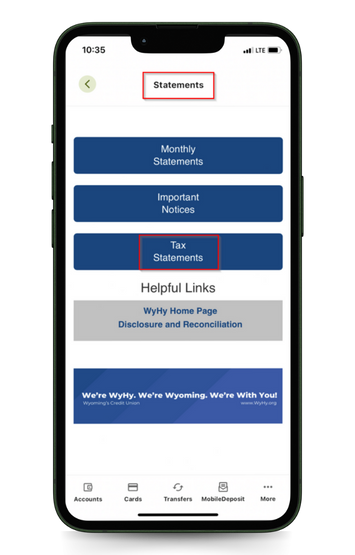

Q: Where can I find my tax statement in WyHy Digital?

A: Tax statements can be found under the eStatement widget. Click Statements, then View eStatements, and there will be a large button called Tax Statements.

See the below images for reference.

Q: Will year end dividend information still be available if I didn't qualify for a tax statement?

A: Yes. The December statement will include the dividends earned plus loan interest paid at the top of the statement.

Q: Does WyHy FCU offer any help with TurboTax or filing?

A: No. We are not accountants and cannot instruct you on how to file your taxes. However, we can offer a discount on TurboTax products.

Q: What else do I need to know?A: It’s a good idea to

review IRS tax deadlines, extension options, and other important dates so you can plan ahead and avoid surprises.

Make the Most of Your Tax Refund!

If you're expecting a tax refund this year, put it to good use! Consider opening a WyHy Certificate to grow your savings with a guaranteed return, or talk to our Wealth Management Team to explore smart investment options tailored to your financial goals. No matter the size of your refund, making strategic financial decisions today can set you up for success tomorrow.

Open a Certificate Schedule a Consultation

If you need any additional information, please contact the WyHy Call Center at 1.800.442.2392.

Happy tax filing!

- Your friends at WyHy FCU