-(1).aspx)

In the past when you wanted to use your home’s equity you had to choose between the flexibility of a HELOC or the steady payments of a fixed rate Home Equity Loan. Now, you can have both with WyHy’s new Hybrid HELOC.

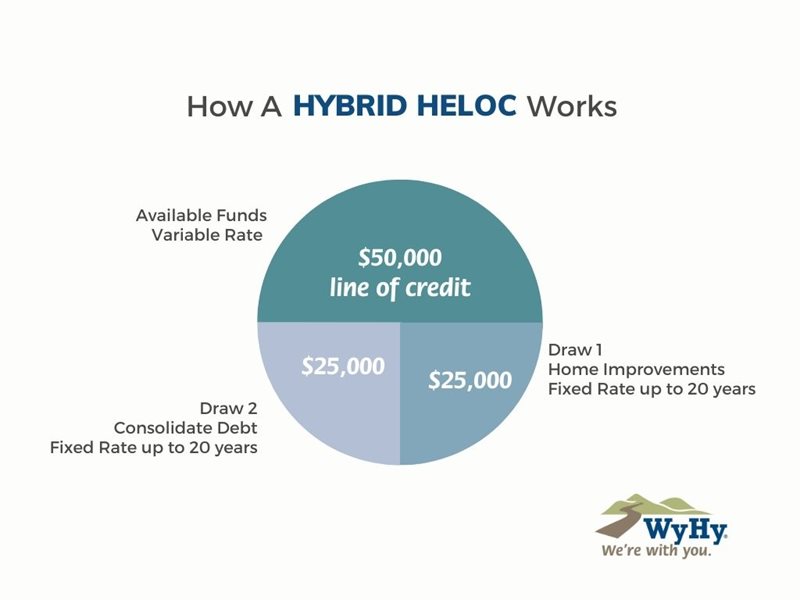

First, let’s quickly review the difference between a Home Equity Loan and a HELOC. Both loans let you access the equity you have in your home while using your home as collateral and therefore have much better interest rates than personal loans and credit cards. The main difference between a Home Equity Loan and a HELOC is that a Home Equity loan comes with fixed payments and a fixed interest rate for the loan, while HELOCs are generally revolving credit lines that come with variable interest rates and variable payment amounts. Now, you can have the advantages of both these types of loans with our new Hybrid HELOC which offers the flexibility you deserve and is easy to use. Your Hybrid HELOC starts out as a line of credit and allows up to two fixed loan segments so your rate on each specified amount remains fixed no matter what.

.aspx?width=800&height=600)

Also, with a Hybrid HELOC, you can use the value you’ve built up in your home to pay for a variety of different things. Rather than pulling out all of your equity in one lump sum, you have access to the funds in bits and pieces when you need them.

For Example: Let's say you're looking to do a bathroom remodel:

You have a $100,000 HELOC with a balance of $50,000 on the line of credit, with $50,000 still available.

So you decide to “fix” $25,000 as one of your fixed-rate segments.

Your fixed balance of $25,000 comes with a 10-year amortization.

Your available line of credit is still $50,000.

Your balance in the line of credit is now $25,000 at the same variable rate, with the other $25,000 locked into your fixed-rate segment.

You can use your HELOC funds at any time, for whatever purpose you choose

-

Debt consolidation

-

Home remodeling or repairs

-

Education expenses

-

And more

Hybrid HELOC Benefits

-

Keeps payments steady by locking in a fixed-rate

-

Provides easy access to the equity in your home

-

Used for recurring home remodeling, major purchases, tuition costs, and any other use

Lock Requirements

-

$30 Fee

-

Sign a Fixed-Rate Conversion Form

Talk to one of our trusted advisors today to find out how this new Hybrid HELOC can work for you!

We're with you!

Apply for a Hybrid HELOC Today!